Alternative Fuels Tax Credit

Interest in propane as an alternative transportation fuel stems from its domestic availability, high-energy density, clean-burning qualities, and relatively low cost. It is the world’s third most common transportation fuel, behind gasoline and diesel, and is considered an alternative fuel under the Energy Policy Act of 1992.

For more information see IRS Form 4136, Credit for Federal Tax Paid on Fuels.

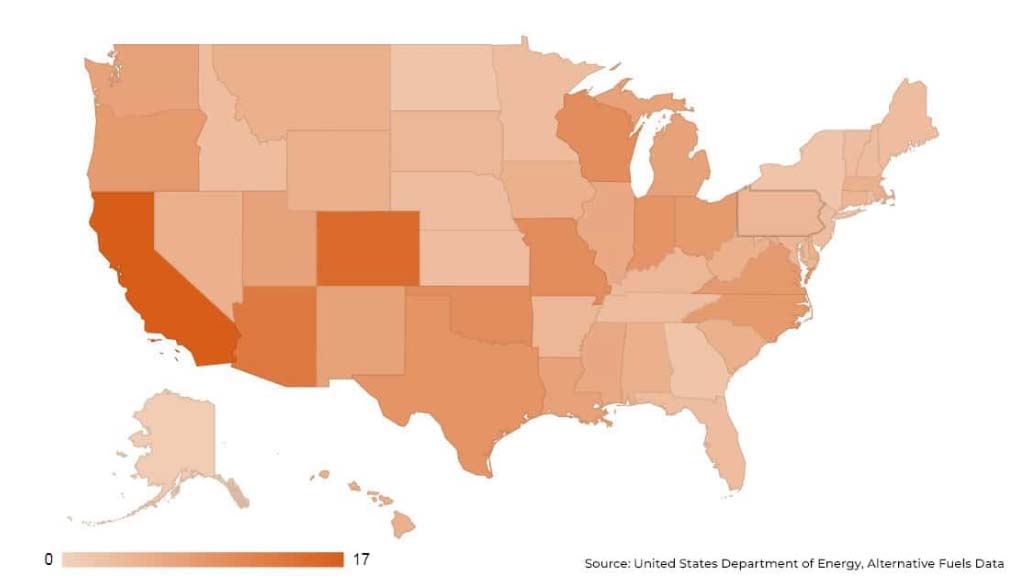

Propane Laws and Incentives by State

Many states have laws and incentives related to the use of propane as a vehicle fuel. Visit the Laws and Incentives page to read specific pieces of legislation or for information on federal polices.

Click here to view the laws and incentives by state or click the map below.

Propane Calculators

Mower

Unlike conventional fuels, propane generates ongoing savings over the life of your mower. To see how much propane can save you, simply input your numbers to see your potential savings compared with gasoline or diesel.

Use this calculator to see how much you could save by implementing propane mowers.

Forklift

Propane forklifts don’t just keep emissions low — they also keep your total infrastructure costs lower than electric. Use our calculator to see the potential numbers for your operation size.

Irrigation

Whether your agricultural business is large or small your business may benefit from the cost saving of a propane powered irrigation engine.

Use this calculator to compare the cost of propane engine vs a diesel engine.

Fleet

In addition to being more environmentally friendly, propane autogas also provides the lowest total cost-of-ownership compared with other fuels.

Use this calculator to determine the cost and ROI of implementing propane autogas vehicles into your fleet.

Incentives & Rebates

Farm Incentive Program

Sponsored by the Propane Education & Research Council (PERC), the Propane Farm Incentive Program is a research program that provides a financial incentive up to $5,000 toward the purchase of new propane-powered farm equipment. In exchange, participants agree to share real-world performance data with PERC.

For more information on the program visit PERC. Use this irrigation calculator to determine your propane could save your operation.

Builder Incentive Program

To promote the construction of all-propane homes within the United States, the Propane Construction Incentive Program offers builders and re-modelers up to $1,500 for each home built or remodeled to the Propane Energy Pod model. Construction professionals are eligible to receive the incentive for up to five homes per state, for a total of up to $7,500 per year. Eligible homes use propane equipment for space heating, water heating, cooking, and other heating and power applications.

It’s a win-win for you and your customers, who will enjoy the improved energy efficiency, performance, comfort, and carbon-emission reductions of Energy Pod Homes when compared with all-electric counterparts. For more information visit PERC.

Rinnai Rebate

Rinnai America Corporation will once again extend our Rinnai Propane-Fired Products Promotion in 2020. This promotion is designed to provide consumers up to a $100 Rebate for purchasing eligible Rinnai propane-fired products! Click here for more information on the rebate or to download the Claim Form.

Peace of mind

with dependable

fuel supply, when

you need it

COMMUNITY

700+

Locations providing exceptional service to local communities across 42 states

EXPERIENCE

95+

Years serving our customers and their communities. Customer satisfaction since 1928

CUSTOMER SERVICE

3,300+

Dedicated employees ready to assist you with quality service for all your fuel needs

RELIABILITY

24/7/365

We are here for you with customer service representatives standing by to take your call

Please call us 24/7/365 at 1-800-PROPANE