Propane Autogas for Fleet Vehicles

Propane makes for an effective autogas alternative because it is an efficient, clean source of energy.

What is autogas?

Propane, also known as liquefied petroleum gas (LPG), makes for an effective autogas alternative because it is an efficient, clean source of energy.

For many fleets, it is an effective and convenient way to offer on-site fueling in an affordable way. Propane autogas is a clean alternative fuel approved under the Clean Air Act of 1990 and the third most popular vehicle fuel worldwide behind gasoline and diesel.

Which fleet vehicles can use autogas?

Many light, medium and heavy duty vehicles are equipped or can be easily equipped to utilize propane as an autogas fuel source. Some vehicles come prepared to efficiently operate with propane’s higher temperature and lower lubricity. Here are some fleet vehicles that are perfect for using propane:

- Shuttle Buses

- Delivery vans and trucks

- Commercial vans, like those used by electricians and plumbers

- Farm Equipment

- Municipal vehicles, like snow plows

- First-responder vehicles

- Moving Vans

- Food service and catering trucks

- School Buses

- Food Delivery and Beverage Parcel Trucks

- Baracade Companies

Why consider using autogas:

Using propane as an autogas alternative fuel source may result in extending the life of your engine as propane is low in carbon and has low oil contamination. Propane is also a perfect autogas source in cool climates because the fuel’s mixture is completely gaseous, preventing cold-start complications that can sometimes plague other fuel sources. Here are other reasons:

- High octane rating

- Easy refueling

- Low oil contamination

- Cleaner for the environment compared to diesel and gasoline

- Proven propane autogas vehicles to get the job done

- Reliable compared to diesel based vehicles

- Domestically produced

- Cleaner alternative compared to electric in 38 states

- Lower maintenance costs

- Lowest total cost of ownership compared to an fuel

Is using autogas safe to use for my fleet?

According to the Propane Education & Research Council (PERC), there are about 200,000 propane-fueled vehicles on the roads. It is a perfectly safe alternative to conventional fuel due to its natural chemical composition, stringent codes and regulations and the industry’s safety and training programs.

When it comes to the environment, propane-powered vehicles oftentimes produce less amounts of harmful air pollutants and greenhouse gases. This makes it a safe and environmentally friendly option.

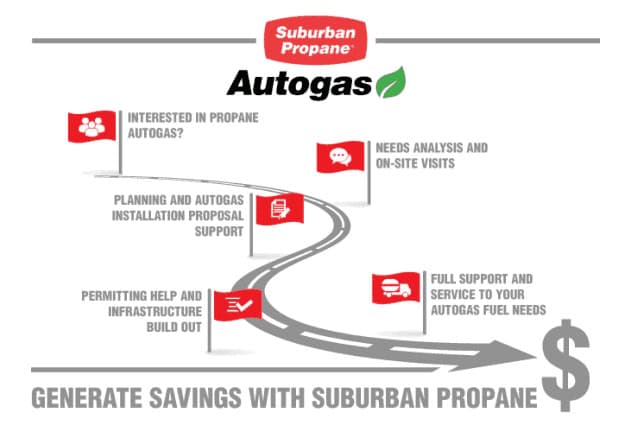

Why Choose Suburban Propane for your autogas vehicle fleet needs

With Suburban Propane as your energy partner, you benefit from quality refueling equipment, reliable fuel delivery, nationwide coverage and safety trained professionals to serve you.

We install a variety of on-site refueling stations and dispensing equipment tailored to the needs of your fleet. With over 675 company locations nationwide, Suburban Propane can make daily, weekly or monthly autogas deliveries based on your usage needs.

Whatever you require, Suburban Propane has the right options and services for your business.

Peace of mind

with dependable

fuel supply, when

you need it

COMMUNITY

700+

Locations providing exceptional service to local communities across 42 states

EXPERIENCE

95+

Years serving our customers and their communities. Customer satisfaction since 1928

CUSTOMER SERVICE

3,300+

Dedicated employees ready to assist you with quality service for all your fuel needs

RELIABILITY

24/7/365

We are here for you with customer service representatives standing by to take your call

Please call us 24/7/365 at 1-800-PROPANE